Contents:

Although bookkeepers are not responsible for filing a business’s taxes, they do often act as financial interpreters between companies and accountants. A business bank account keeps your personal finances separate from your business finances. For LLCs and corporations, keeping separate finances is essential for maintaining liability protection.

It’s really touch and go at the moment with a lot of these new companies. They’re raising a lot of money, but they aren’t exactly proven yet. I’m an entrepreneurial CPA that founded Xen Accounting, a 100% cloud-based accounting firm, in 2013.

The more detailed it is, the better public accounting be prepared for various situations that can occur as a business owner. Professional associations also offer certifications so that you can hone your skills and market yourself as a professional bookkeeper. For instance, both the American Institute of Professional Bookkeepers and the National Association of Certified Public Bookkeepers offer certification programs. Annual profits of bookkeeping businesses vary, however, you can make anywhere from $10,000 to several million dollars a year. It will all depend on how you manage and scale your business. To run a successful business, make sure your business stands the test of time so you can consistently get bookkeeping clients, you’ll need to engage in continuous improvement.

Client Requests & Auto Reminders

As CEO of CorpNet.com, she has helped more than half a million entrepreneurs launch their businesses. A passionate entrepreneur herself, Akalp is committed to helping others take the reigns and dive into small business ownership. Document Management Software – You and your clients will exchange a lot of information. Consider what solution will enable you to receive, share, and file documents and data effectively. Examples of tools that can help include Google Drive, G Suite, Hubdoc, Expensify, Wave, Shoeboxed, OneDrive, and Dropbox.

That is why you need an accounting workflow software like Financial Cents. It was specifically built to help bookkeeping firms track the status of client work and important deadlines. LinkedIn ProFinder is a great platform for virtual bookkeepers who want to gain high-end clients. On LinkedIn, you can showcase your experience and background while connecting with potential customers who are likely looking for more comprehensive services.

Create a Bookkeeping Business Plan

In many cases, registering your business is as easy as simply registering your business name. However, the type of business model you choose and your location will affect the business registration process. At this point, your head might be spinning with all the info.

Air Force Launches Investigation of Teixeira’s Guard Unit After Leak Arrest – Military.com

Air Force Launches Investigation of Teixeira’s Guard Unit After Leak Arrest.

Posted: Tue, 18 Apr 2023 21:06:41 GMT [source]

Time is money and when you’re pushing hard to scale up your business, you need all the time you possibly have to focus on that goal. Having to spend hours sorting through receipts and bills just so you can balance your books will be a major hindrance. Finding a niche will also help you expand and earn more since you can learn the specific ins and outs of your clients’ business challenges. Look at the 3-7 goals you created in the 1-year plan and chunk those down into 3-7 specific, measurable & attainable priorities for you to attack in the next 90 days. Project your desired revenues for your business entity at that future date. Most of inexperienced bookkeepers primarily rely on a combination of existing skills and on-the-job training.

Create a Business Plan for Your Bookkeeping Business

Many states require residents to have some level of health insurance coverage. Health insurance is a much sought-after benefit if you plan to hire employees. If your virtual bookkeeping firm has employees in several states, you may want to work with an insurance agent to find coverage that works for all your employees.

As you establish a client base and get more comfortable with your bookkeeping business, continue your learning and consider offering more services. And any time you add a new service is a great opportunity at which to re-evaluate your pricing structure and sell your clients on those new packages! Developing a more robust set of offerings is also a solid way to attract new clients. The capital for starting a virtual bookkeeping business should cover costs like creating a website and a subscription to a bookkeeping software solution. That’s in the case that you already own a desktop computer or a laptop. If not, your costs will be higher because you need a reliable device to offer virtual bookkeeping services.

In order to be considered a legal bookkeeping business, you need to decide what form of business entity to establish, and then file your company with your state. The most common forms of business are a Sole Proprietorship, Partnership, Corporation, and S Corporation. A Limited Liability Company is a business structure allowed by state statute. Did you know that bookkeeping is consistently named among the most profitable at-home businesses to start? The start-up costs are minimal, and the earning potential is high, which makes for a great side hustle or full-time career.

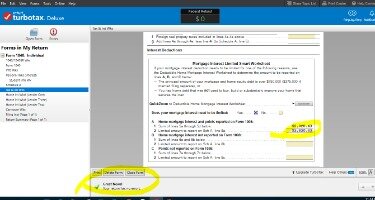

Also known as a Federal Tax ID Number, an EIN is a unique nine-digit number used for identifying a business on tax forms and other documents. Most banks will require an EIN before they will open a bank account for a business. EINs are free and obtained through the I.R.S. If you don’t have the time or don’t want to handle the paperwork on your own, CorpNet can help you apply for your EIN. You should check with the local authorities to see if you need any licenses to make your bookkeeping business stay legally compliant.

What Skills Do You Need to Start a Virtual Bookkeeping Business?

Sometimes, members can get discounted rates on these events as membership perks. Being part of these associations can also help you build your network with other bookkeepers, CPAs, and tax experts. Investing the time to attend a conference will give you those continuing education credits you need to keep your bookkeeper or CPA certification. It’ll also enable you to learn what the hottest trends in the industry are and what’s becoming obsolete. A great conference to attend is QuickBooks Connect, which is hosted by Intuit.

Would you even need to know a specific accounting platform if you are working these types of models? I jumped from corporate to small business because I spent a lot of time doing general management reporting and I felt like I could provide that same support to small businesses. To connect with them, I had to lead with doing bookkeeping and then show them how much more I can do.

Do this by opening a business account, putting some money in it as an owner’s investment, and using it to pay all expenses related to your business. To move forward with your bookkeeping business, you need a business plan. Of course, becoming a competent and proficient bookkeeper still takes time and money.

All of your transactions, whether digital or cash, will be logged accurately through the accounting software they use. Expenses can also be tracked seamlessly so that you always know exactly what the financial health of your business is. Most small business owners tend to do their own bookkeeping. It’s a viable solution as they may not be making enough in the beginning to hire a bookkeeping service. As the business grows, they inevitably feel the need to opt for either a conventional accounting service or an online bookkeeping service. Other benefits of G Suite and that low monthly fee are 30GB Cloud Storage, Shared Calendars, and access to G Suite’s document, spreadsheet, and similar office systems.

- It is a comprehensive document that explains not only your services but also your market and the competitive advantage you’ll have in your business.

- In order to be a quality bookkeeper, you need to learn the tricks of the trade.

- You do not need to become a Certified Professional Accountant to be a bookkeeper, though doing so will increase the variety of services that you can provide to your clients.

- You will also create a financial plan that should include a 12-month profit and loss projection, projected cash flow, and a projected balance sheet.

- Unlike some related career fields, such as accounting, you don’t need a specific degree to be a bookkeeper.

Unless they are a certified public accountant , bookkeepers should not prepare tax returns or sign the returns as a paid preparer. I have a dream to help several number of other companies having bookkeeping challeges. I started my journey to this dream by drafting some 2 paged idea plan of bookkeeping business however my plan was sketchy and was missing alot. I want to be self employed in my proffession but one who fits in the 21st century technology. For example, when I decided to start my own accounting firm, my purpose was to provide small local business owners with an easy, pain-free accounting & bookkeeping experience.

An online bookkeeping service will be much more affordable compared to a traditional bookkeeping company. It’s also easier to integrate with your workflows and is generally more efficient. Guide Your Clients – Having organized and accessible services on your website will allow you to get clients familiar with what your business has to offer.

Borrell: EU cannot trust China unless it seeks peace in Ukraine – Arab News

Borrell: EU cannot trust China unless it seeks peace in Ukraine.

Posted: Fri, 14 Apr 2023 06:14:59 GMT [source]

Now that we’ve provided you with a roadmap to get your bookkeeping business started, I want to challenge you to pick a date for when you would like to be ready to take that first client. When starting out, keep your costs low by setting up a home office. If possible, plan to meet your clients at their offices or virtually. I don’t recommend inviting clients to your home office unless you know them very well and have a private room where you can work. Read our home office setup ideas to learn about the must-haves and productivity hacks. As a one-person operation, you may find it hard to get back to clients right away, especially during tax season.

Fortunately, there are several ways you can learn, both online and in person. Virtually all community colleges offer bookkeeping courses. The cost per credit hour is generally much lower than a traditional four-year college, and you can attend full-time or part-time, depending on your schedule. Now that you understand the fundamental startup costs, let’s look at the steps you’ll need to take to launch your new bookkeeping business. This stress-free virtual bookkeeping service is used by thousands of busy founders across the globe to accurately track their expenses and sail through the tax season. If you have been doing it all by yourself, keeping accurate books will become a challenge when your business grows.

Networking can happen anywhere from a chamber of commerce meeting to the dentist’s office or the school pickup line. Having business cards already made can help you spread the word with information on how to find you. You may also consider a brochure or flyer to share both in person and online. To do this, you have to set up your business in a very specific manner. This just ties you down geographically and kills your earning potential. Experience is important for so many careers, but for bookkeeping, experience isn’t a make-or-break deal.

Most small businesses require high startup costs such as renting or buying a building, purchasing inventory, and buying supplies. Bookkeeping is one of the less-daunting business options, and there are several practical reasons to start your own bookkeeping business. Overall, bookkeeping is more straightforward than accounting and is mostly about keeping track of the money in day-to-day transactions. Next, focus on the platforms where your target customers are active. LinkedIn is a great place to start since it’s geared toward professionals and entrepreneurs.

Jeannette McCabe Obituary (1926 – 2023) – Delmont, PA – Tribune … – Legacy.com

Jeannette McCabe Obituary (1926 – – Delmont, PA – Tribune ….

Posted: Tue, 18 Apr 2023 23:50:58 GMT [source]

However, becoming licensed or having a certification behind your name can instill customer trust and confidence in your abilities. For those of you considering a bookkeeping business, I’ve listed many of the details you’ll need to address. This information is intended to give you a general sense of what’s involved and is not a substitute for professional legal, accounting, and tax advice. There are a lot of moving parts when running your bookkeeping business.